maine transfer tax calculator

2020 -- 1350 per 1000 of value. It adds up to 200 per pack.

Maine Vehicle Sales Tax Fees Calculator

On any amount above 400000 you would have to pay the full 2.

. Municipal Services and the Unorganized Territory. Local tax rates in Maine range from 550 making the sales tax range in Maine 550. To calculate your estimated registration renewal cost you will need the following information.

2017 Older -- 400 per 1000 of value. Share this Page How much will it cost to renew my registration. The state has a high standard deduction that helps low- and middle-income Mainers at tax time.

YEAR 3 0135 mill rate. The tax is imposed ½ on the grantor ½ on the grantee. Maine has a 55 statewide sales tax rate and does.

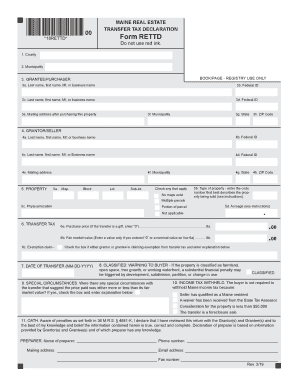

A mill is the tax per thousand dollars in assessed value. If at least than half half transfer tax state of maine real estate transfer tax - tax rates 25001 25500 5610 5610 11220 25501 26000 5720 5720 11440 26001 26500 5830 5830 11660 26501 27000 5940 5940 11880 27001 27500 6050 6050 12100 27501 28000 6160 6160 12320 28001 28500 6270 6270 12540. The current rate for the Maine transfer tax is 220 per every 500 of the sale.

For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. The transfer tax is collected on the following two transactions.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Maine is an alcoholic beverage control state meaning the states Bureau of Alcoholic Beverages and Lottery Operations controls the wholesale of liquor and fortified wines within the state. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

2019 -- 1000 per 1000 of value. Controlling Interest - A separate ReturnDeclaration must be filed for each transfer of a. Advertisement step 1 identify the amount of the states transfer tax.

No Maine cities charge a local income tax. The amount is calculated as 220 per 1000 of the sales price. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Maine Transfer Tax Calculator. The state valuation is a basis for the allocation of money. The Real Estate Transfer Tax RETT database is an electronic database that allows.

The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. YEAR 4 0100 mill rate.

The rates drop back on January 1st of each year. YEAR 1 0240 mill rate. Users to create and electronically file RETT declarations.

If you buy cigarettes in Maine youll have to pay the states cigarette tax. The Property Tax Division is divided into two units. MRS to approve RETT declarations.

As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. Our maine state tax calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 6250000 and go. As such each party is required to pay 110 per every 500 or 220 for every 1000 of the price of the home.

The base state sales tax rate in Maine is 55. Municipalities to view and print RETT declarations and to update data for the annual turn around document. Maine Cigarette Tax.

Thats why we came up with this handy Maine sales tax calculator. Your employer withholds money to cover your Maine tax liability just like it. The rates that appear on tax bills in Maine are generally denominated in millage rates.

Maine has a progressive income tax system that features rates that range from 580 to 715. Maine transfer tax calculator. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehiclePlease note this is only for estimation purposes the exact cost will be determined by the city when you register your vehicle.

Our calculator has been specially developed in order to provide the users of the calculator with not only how much. The current rate for the maine transfer tax is 220 per every 500 of the sale. Maine Property Tax Rates.

2022 -- 2400 per 1000 of value. Recording and Transfer Charges-A small fee to 50 to 150 to cover the cost of the paperwork required to record your home purchase. Documentary Stamp Tax Transfer Taxes-Are collected by the state of Maine and are paid equally by the buyer and the seller.

YEAR 2 0175 mill rate. You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122. 2018 -- 650 per 1000 of value.

2021 -- 1750 per 1000 of value. This rate is split evenly between the seller and the purchaser. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

The rates that appear on tax bills in Maine are generally denominated in millage rates. Find your Maine combined state and local tax rate. Departments Treasury Motor Vehicles Excise Tax Calculator.

Calculation will be based on. Registries to process RETT declarations. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Maine Real Estate Transfer Taxes An In Depth Guide

Dmv Fees By State Usa Manual Car Registration Calculator

Maine Vehicle Sales Tax Fees Calculator

What You Should Know About Contra Costa County Transfer Tax

Where S My Refund Maine H R Block

Maine Vehicle Sales Tax Fees Calculator

Maine Real Estate Tax Fill Out And Sign Printable Pdf Template Signnow

Transfer Tax In San Diego County California Who Pays What

Maine Car Registration A Helpful Illustrative Guide

Transfer Tax Calculator 2022 For All 50 States

How To Calculate Transfer Tax In Nh

How Much Are Closing Costs For Sellers In Maine

Maine Vehicle Sales Tax Fees Calculator

A Breakdown Of Transfer Tax In Real Estate Upnest

Transfer Tax Alameda County California Who Pays What

Transfer Tax In San Luis Obispo County California Who Pays What